MASTER GLOBAL E-BILLING

The Global E-Billing process —that of creating, submitting, auditing, correcting and approving invoices— requires a mastery of intricate and varied jurisdictional rules, policies and laws that confound the very definition of an “invoice.”

Schedule an interactive one-on-one workshop and learn the essential steps for implementing a successful Global E-Billing program.

INTEGRATED GLOBAL INVOICING AND TAX COMPLIANCE WORKSHOP

GLOBAL INVOICING IS HARD. DON'T GO IT ALONE!

It’s the painstaking process of understanding AND managing specific areas of invoicing

FOR EACH AND EVERY COUNTRY YOU DO BUSINESS IN:

|

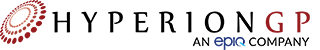

Hyperion's Integrated Global Electronic Invoicing and Tax Compliance Program is a fixed-fee, all-inclusive program developed by experts in international legal invoicing rules and tax management. Our complete integrated work program will help you navigate the myriad business and technical requirements –and the complete ecosystem of stakeholders –to deliver the design and deployment of a COMPLETE INTEGRATED GLOBAL E-BILLING APPARATUS, informed by and compliant with the international laws and regulations that impact all facets of the process.

The Program delivers everything you need to navigate the global invoicing landscape:

WE LITERALLY WROTE THE PLAYBOOK FOR GLOBAL E-BILLING

GET THE HELP YOU NEED TO NAVIGATE THE COMPLEX GLOBAL INVOICING LANDSCAPE. THE GUIDE PROVIDES INSIGHT ON:

- Key core requirements to help establish a basic framework, serving as excellent best practices for tax and policy compliance

- Complexities around electronic invoicing and regulations controlling VAT

- Processes and limitations of current web-based e-billing systems

- Data privacy regulations for both corporations and law firms

- Taking advantage of technologies you already have in place

.png?width=450&height=96&name=HyperionGP_PRODUCTION_an%20epiq%20company%20(3).png)