Tuning the Drive to Replace Technology

Businesses are under constant pressure to adapt to improvements in enterprise technology. Much like the average consumer who anxiously awaits the release of the next generation iPhone, businesses might be eager to integrate the latest developments into their enterprise systems. Replacement of an enterprise technology, however, requires much more planning and effort than the replacement of a smartphone.

Though legal operations technology may not evolve at the rapid speed of consumer electronics, software developers are constantly rolling out new features, upgrades, and entirely new systems on a regular basis.

Legal operations teams are regularly challenged to handle increased workload with fewer resources and shrinking budgets. Additionally, contemporary trends provide evidence of a rapidly shrinking horizon for Total Cost of Ownership; while legal technology investments were once evaluated on a 7-to-10 year TCO, these projects are now being planned on a 3-to-5 year horizon. Thus, ROI has to be near immediate, and implementation efficiency is a significant factor in a technology upgrade decision.

At Hyperion Research, we continue to see a considerable increase in legal technology RFPs in 2017, driven by a number of important market dynamics, both organic – including important evolutions in technology like HTML5 and maturity in line-of-business disciplines – and contrived (recent market consolidation activity has driven significant momentum). Our recent research about business technology decision processes gives us insight into the myriad factors motivating today’s decisions for replacing incumbent legal operations/practice management technology:

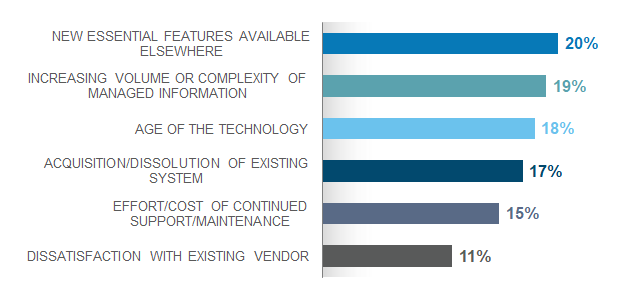

Fig 1. How do you decide it's time to replace incumbent technology?

At first glance, these figures demonstrate a fairly even distribution of reasons for replacing incumbent technology. The top five responses are separated by a slim 5% margin, which indicates no single dominant factor. The more useful insight, however, comes when we look at the types of drivers – the responses fall along two important trends: strategic decision-making versus reactive.

The decision to replace technology is considered reactive if it is made based on perfunctory factors, such as the age of technology, or if the technology has been acquired or dissolved. Reactive decisions are a latent response to changes in the technology market, and are often driven by IT departments – a new version is released driving the need to upgrade, a five-year old solution is deemed outdated, or a solution provider is acquired, leading to fears of product obsolescence. These reactive factors account for a full 35% of technology investment decision today.

Alternatively, 39% of operational technology investments are strategic in nature. Strategic reasons for upgrading technology are generally driven by the evolution of an organization’s needs, such as the need to increase the volume or complexity of managed information (19%), or the need for new essential features not offered by current applications (20%). When a firm upgrades their technology for strategic reasons, they are more aware of the role that technology plays in their operations, and seek to actively integrate operational needs with technology ones.

Between the anchors of the Strategic/Reactive spectrum lies a sort of middle ground defined by decisions that straddle the esoteric. This includes 15% of decisions based on the burdensome efforts and costs of continued support and maintenance, and 11% of decisions rooted in simple dissatisfaction with their current technology vendor. These might be considered either reactive or strategic, and managers must not let the reactive tendency become dominant. For example, reasoning based on a nonresponsive vendor support team or the cost of maintenance does not tend to serve companies well in the long term. However, if the decision is based on a thoughtful investigation of the overall competency of a support team, then a company can strategically align its anticipated needs with available capabilities.

Organizations that make technology decisions based on strategy have an advantage over those that merely respond to changes in the market.

Best practices for replacing incumbent technology should focus on a detailed understanding of your organization’s unique needs. When major technology plans and decisions are made based on conventional wisdom, on an imposed set of operational criteria, you immediately limit the contours of a decision-making process. Managers must evaluate their technological requirements, and how they anticipate that these needs will evolve within 3 to 5 years. Technology investments, then, should be made in anticipation of the future needs of the business. Interestingly, solution providers are keen to take note of strategic technology acquisitions: the successful integration of the strategic needs of the business with technology requirements is highly influential to the leading solution roadmaps and the features that grow to define the market.